Polish economy as an environment

Area: Management, Finance, Operations

Relation to: Growth Opportunities, Sales, Operations

Importance: High

Impact on revenues: High

Impact on costs: Medium

Share this page

An impressive economy

Today, Poland is the largest economy in Central and Eastern Europe (CEE), with a 30% share of the region’s total GDP ($1.9 T). As pointed out by McKinsey&Company’s Poland 2030 report, the development of the Polish economy over the past few decades has been impressive. In fact, the country has demonstrated unique economic performance starting from 1990s. Since the first transformations that began after the end of the Cold War, Poland’s economy has been continuously growing, becoming the biggest contributor to the GDP of the European Union among the CEE region. As a consequence, the economy is now so mature that Poland no longer needs to chase the European champions: it can start charting its own development path.

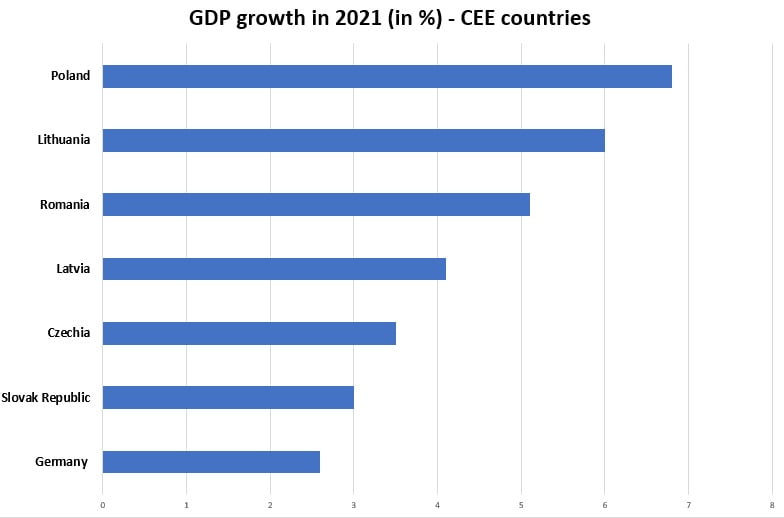

Source: World Bank

In recent years, like the rest of the world, the Polish economy was affected by the COVID-19 pandemic and war in Ukraine, but we are a country that handles global crises exceptionally well. Poland was the only EU country that avoided recession during and after the 2007–2009 financial crisis and as indicated by McKinsey & Company (download the full report here), Poland was one of the fastest-growing economies worldwide pre-crisis and the fastest-growing economy in post-crisis Europe. The same applies to the COVID-19 crisis. The decline in GDP in Poland in 2020 was one of the smallest in Europe (-2.0%) and was followed by 6.8% growth in 2021 and forecasted 4.9% growth in 2022, hence Polish economy once more proved its outstanding resilience.

How long Poland has come since the end of the XX century can be clearly seen not only in publicly accessible statistics but also in many international rankings. As early as 2014, Poland was the best country for business in Eastern Europe and Central Asia according to Bloomberg. Four years later, in 2018, Bloomberg ranked Poland No. 4 in the world among the most attractive emerging markets, and in 2021, after analyzing 111 countries, the same broadcaster introduced Poland as the 23rd most innovative economy in the world (for more details download Invest in digital Poland report available here). Furthermore, in 2020, The Global Entrepreneurship and Development Institute placed Poland among the 33% of the most entrepreneurial and digital countries in the world. In the same year, CEOWORLD magazine, in its turn, ranked Poland 3rd in its World’s Best Countries To Invest In Or Do Business For 2020. In the latter ranking, Poland was outperformed only by Singapore and the UK, i.e. it took the leading position in continental Europe. It is even more important that CEOWORLD magazine experts ranked and analyzed 80 countries according to their business and investment environment – the survey was based on 11 different factors including corruption, freedom (personal, trade, and monetary), workforce, investor protection, infrastructure, taxes, quality of life, red tape, and technological readiness (each category was equally weighted).

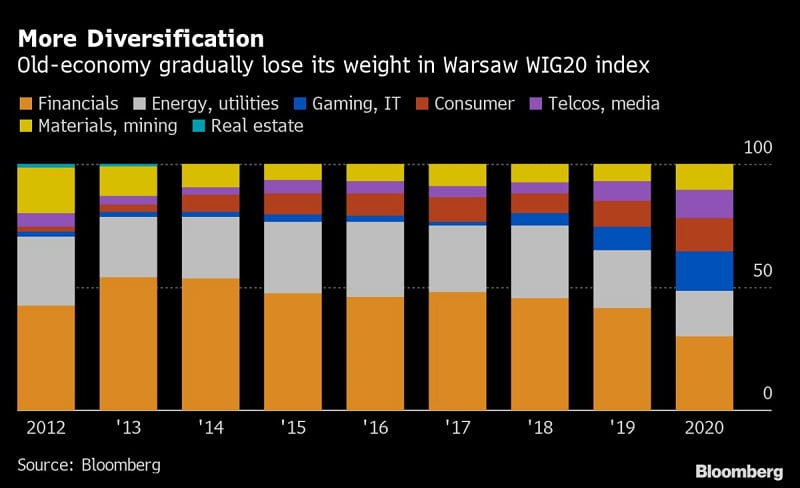

Good global ratings for the Polish economy are based among others on the fact that Poland becomes ever more modern and advanced over time. As Bloomberg points out, “traditional economy” industrials and banks that have previously dominated the stock market index of the twenty largest companies on the Warsaw Stock Exchange are gradually losing their weight. On the other hand, tech companies from sectors such as telecoms, gaming, and IT, as well as e-commerce, are growing in strength.

The increasingly innovative nature of the Polish economy – together, of course, with its increasingly solid foundations – means, as we have already mentioned, that Poland is coping much better than many other countries with challenges such as the crisis caused by COVID-19 and war in Ukraine. Moreover, according to World Bank, the Polish economy was not only more resistant to the COVID pandemic than other countries in the region but even benefited from the effects of the crisis (see NFP’s article here). Many global manufacturing and service companies look for additional savings as a result of the crisis, e.g. by moving some of their structures to countries with lower employment costs (see, for example, the decisions by Alstom, Santander, Netflix, or Volvo which we cover in our News section).

The IT industry is one of the best examples in this case. The pandemic has confirmed that remote work can be implemented much more broadly than previously thought, stimulating cooperation with contractors from different countries and continents. Therefore, the COVID-19 impact on the Software House industry in Poland report (available to download here) observes among other things the fast development of outsourcing from the second half of 2020 (which is a kind of a repeat from the years 2000 and 2009) and states that the Polish IT sector will surely be a beneficiary again. This thesis is confirmed by the data from the report The IT/ICT Sector in Poland – report 2023 that shows, that the total number of companies operating in the ICT sector in Poland after 2021 exceeded 100 000. While the value of telecommunications and IT services provided to foreign partners, either by Polish companies themselves or foreign entities registered in Poland, reached a historic high of nearly EUR 10 billion in 2021. This is an almost 90% increase when compared to 2017 figures.

Another Tech industry in Poland that has not been affected by the COVID-19 crisis is GameDev. According to The game industry of Poland – report 2023, this industry has continued to grow in each of the recent years and currently employs 15,000 people – this is the best result in the entire European Union. Poland exports 97% of its production, with many game titles that have achieved global sales exceeding one million copies. As a result, the Polish GameDev industry’s revenues over the last five years grew by 250% and continue growing.

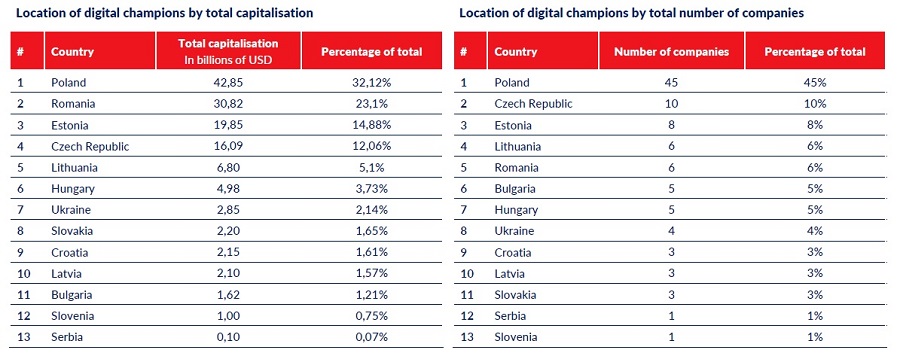

The great thing is also the fact that Poland continues to be among the best locations in the world to start and grow a business (given all the factors involved). This is manifested, for example, in the growing number of newly created startups, including those with high innovation potential. According to Global Startup Ecosystem Index 2022, Poland’s economic growth and talented entrepreneurs indicate that the country has a strong foundation for powerful startup ecosystems. This trend is difficult to stop, even in the face of global crises since, as shown by the European Business and Innovation Centre Network, all scenario analysis by economic institutions and organizations at the continental level show a possible future progression of the Polish startup ecosystem. Examples of this trend are easily found in, among others, in Digital Campions CEE report 2021, which states that almost one in two companies in the ranking of the 100 largest innovative technology companies in the CEE region comes from Poland. And what is worth mentioning, among those companies predominate startups in enterprise software, marketing solutions and game development, which creates Poland a booming hub for the ICT industry.

Source: Digital Champions CEE 2021

The same trend can be seen in the growing number of new branches of international companies, which gain savings and other very important benefits for their operations by locating their structures in Poland. The latter benefits are not as readily available in other parts of the world that are popular with investors. As reported by Reuters, while service centers in Asia can offer lower costs, Central and Eastern Europe offers geographical and time-zone proximity to Western Europe and North America, with a deep pool of multi-lingual workers. And it goes without saying, that Poland enjoys the highest degree of familiarity and proximity to Western Europe and a deep cultural connection with the U.S. This, combined with EU legal protection, makes Poland a safer investment destination with less perceived risk.

Of course, the IT industry is no exception in this regard – for foreign investors it remains one of the most attractive sectors due to its strong position and international reputation and location of R&D activities in the region by global corporations such as Google, Samsung, Microsoft or Netflix speaks for itself. According to Emerging Europe’s IT Landscape: Future of IT report from 2021, Poland is home to the most competitive IT sector of all 23 countries of Central and Eastern Europe and “a true ICT powerhouse”. The country is ranked first in the Emerging Europe’s IT Competitiveness Index, leading the region in terms of ICT employment, ICT value-added, and exports. Moreover, investments in remote engineering teams in Poland are additionally stimulated by a large number of people with high-quality STEM competencies and the very good reputation of Polish IT professionals (for more details, go here). Additionally, Poland is a perfect location for those IT companies which want to leverage a local branch to run sales across the European Union and to process data in a country that has the required data protection and privacy regulations (GDPR). Consequently, the Polish economy offers a highly conducive environment for growth for more international Tech companies, whether the major players or others that are planning to expand to global markets. We offer regular updates on businesses that have created their Tech teams in Poland and on their successes on this website and our Facebook and LinkedIn.